Our Location

304 North Cardinal St.

Dorchester Center, MA 02124

Keywords: Export recovery

In 2024, there still exists significant uncertainty regarding the global economic recovery, with limited improvement in external demand. Therefore, it is even more important to focus on observing changes in ‘value’

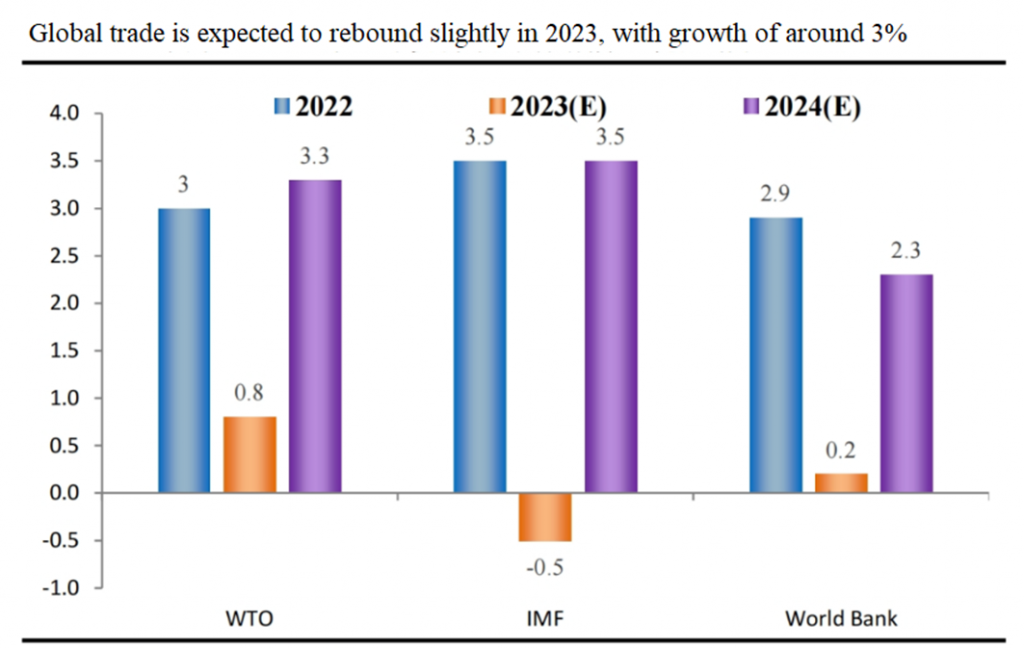

The logic behind the improvement in external demand lies in the end of austerity cycles in developed economies such as the United States and Europe. After a prolonged period of contraction in manufacturing activity, it is expected to gradually improve with the pace of interest rate cuts, thereby boosting demand for industrial goods. Additionally, the year-on-year growth rate of imports of consumer goods in the United States and Europe has already bottomed out and rebounded.

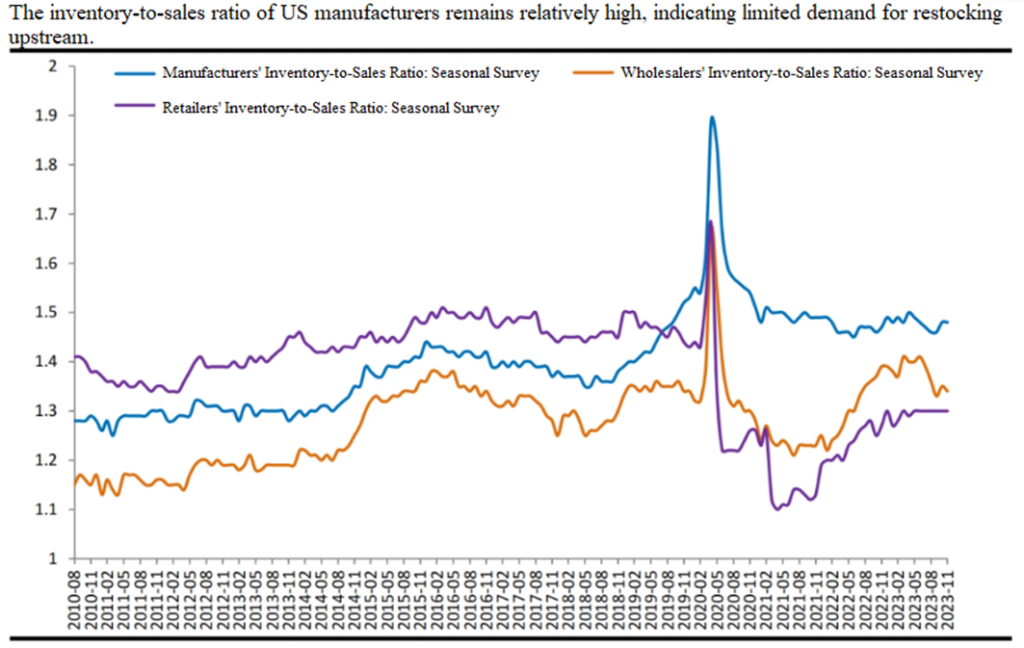

However, the likelihood of a significant improvement in external demand is relatively low. Although inflation in the United States and Europe has eased somewhat, it remains above desirable levels, and credit conditions are unlikely to significantly loosen. The restocking cycle in the United States may be relatively weak, compounded by escalating geopolitical tensions and the approach of a “super election year.”

The key to price improvement lies in the recovery of domestic demand in China, reversing the situation of “price reduction to win orders.” Coupled with improvements in international commodity prices, this is expected to alleviate the pressure of prices on exports.

Therefore, under neutral conditions, China’s exports are expected to experience a slight positive growth in 2024, reaching 3% for the full year (measured in US dollars). Specifically, the baseline scenario for 2024 includes the European Central Bank and the Federal Reserve initiating interest rate cuts in the third quarter, with global economic growth expected to stabilize, driving global commodity trade growth back to a level of 3%. Building on this foundation, as prices cease their negative growth trend, China’s export share is expected to stabilize at 14.2%, with the renminbi exchange rate remaining stable with a slight appreciation.

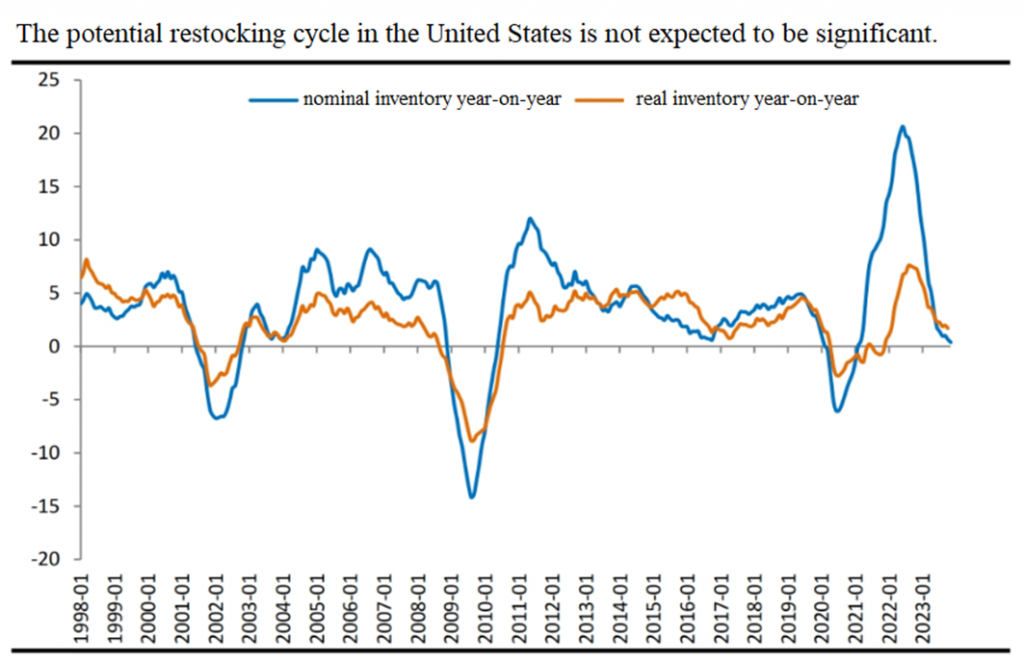

II. The destocking cycle in the United States is nearing its end, and 2024 is expected to transition into a restocking phase, likely marking a weak restocking cycle with limited impact on export growth.

Specifically, the current inventory cycle in the United States began in August 2020 and entered the destocking phase in September 2022. From the perspective of nominal inventories, destocking in the United States has been relatively rapid, with year-on-year growth rates falling from a peak of 21% to less than 1%. However, it can be observed that due to the impact of high inflation, the difference between nominal and real inventory growth rates reached extreme levels in 2021-2022. Therefore, we believe that the traditional approach of judging restocking intensity based on nominal inventories (which includes industrial prices and the demand for industrial goods) has limited guidance in the current context.

Looking at real inventories, the degree of destocking in the United States during this cycle has actually been quite limited. The intensity of this cycle can be compared to the restocking cycle at the end of 2016, with overall intensity not expected to be too great. Instead, there will likely be more structural restocking at the industry level.

III. The “new three items” exports will continue to drive growth.

Industries such as new energy vehicles, lithium batteries, and photovoltaics, which are dominated by the “new three items,” are expected to maintain high growth rates. Automobile exports are expected to continue the trend of increasing both in quantity and value, becoming an important incremental contributor to China’s exports.

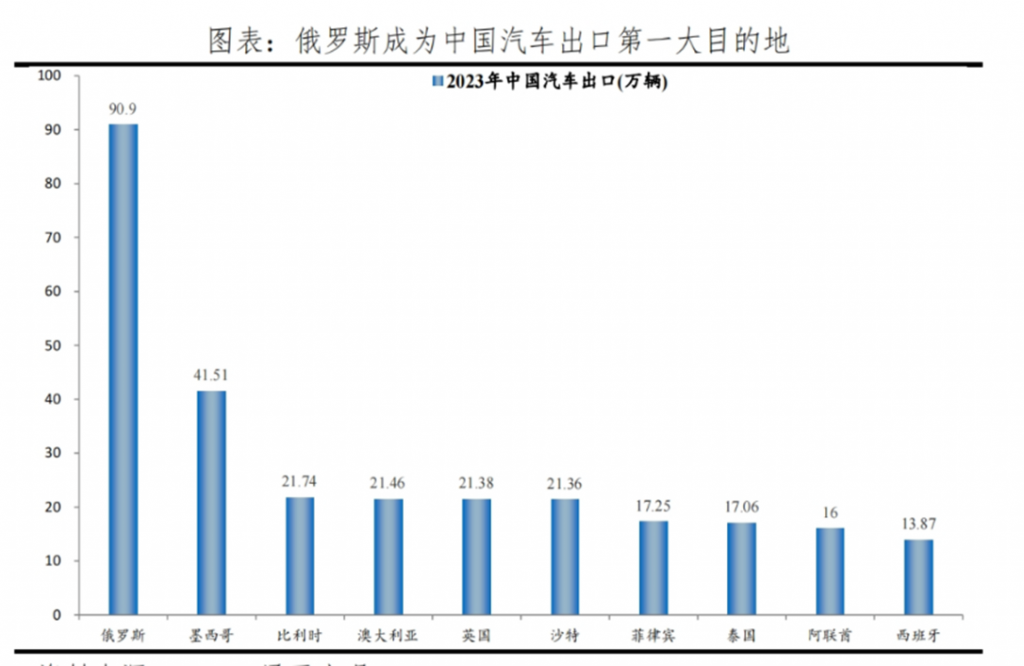

In 2021, total automobile exports reached 2.1865 million units, and by 2023, they had reached 5.2226 million units, representing a compound annual growth rate of 54% over two years. Among them, exports to Russia exceeded 900,000 vehicles, making it the largest destination for automobile exports in 2023.

China’s market share of automobiles in Russia increased significantly from 10% in 2022 to 49% in 2023.

There is further room for penetration of new energy vehicles in exports to Europe. Currently, exports to Europe are mainly fuel-powered vehicles, partly due to climate conditions and partly due to relatively inadequate overseas infrastructure for new energy vehicles. It is expected that infrastructure will further improve in the future.

Along with the increase in quantity, the export prices of new energy vehicles are also continuously rising. The average price of new energy vehicles exported from China is increasing, shifting from the mid-to-low end to the mid-to-high end. The average price of whole vehicle exports (including fuel-powered vehicles and new energy vehicles) increased from 85,000 yuan in 2018 to 122,000 yuan in 2022, and is expected to rise to about 130,000 yuan in 2023. Among them, the average export price of new energy vehicles increased from $15,000 in 2020 to $23,000 in 2022.